Select the Correct Reporting Time Period for Each Financial Statement

The date of financial statements - is the date of the end of the latest period covered by the financial statement. Public companies also report similarly to shareholder owners.

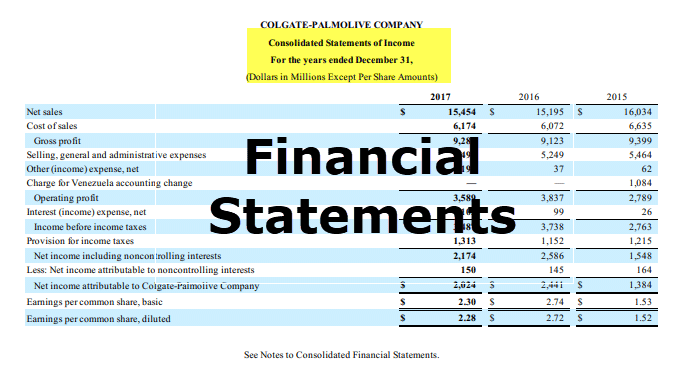

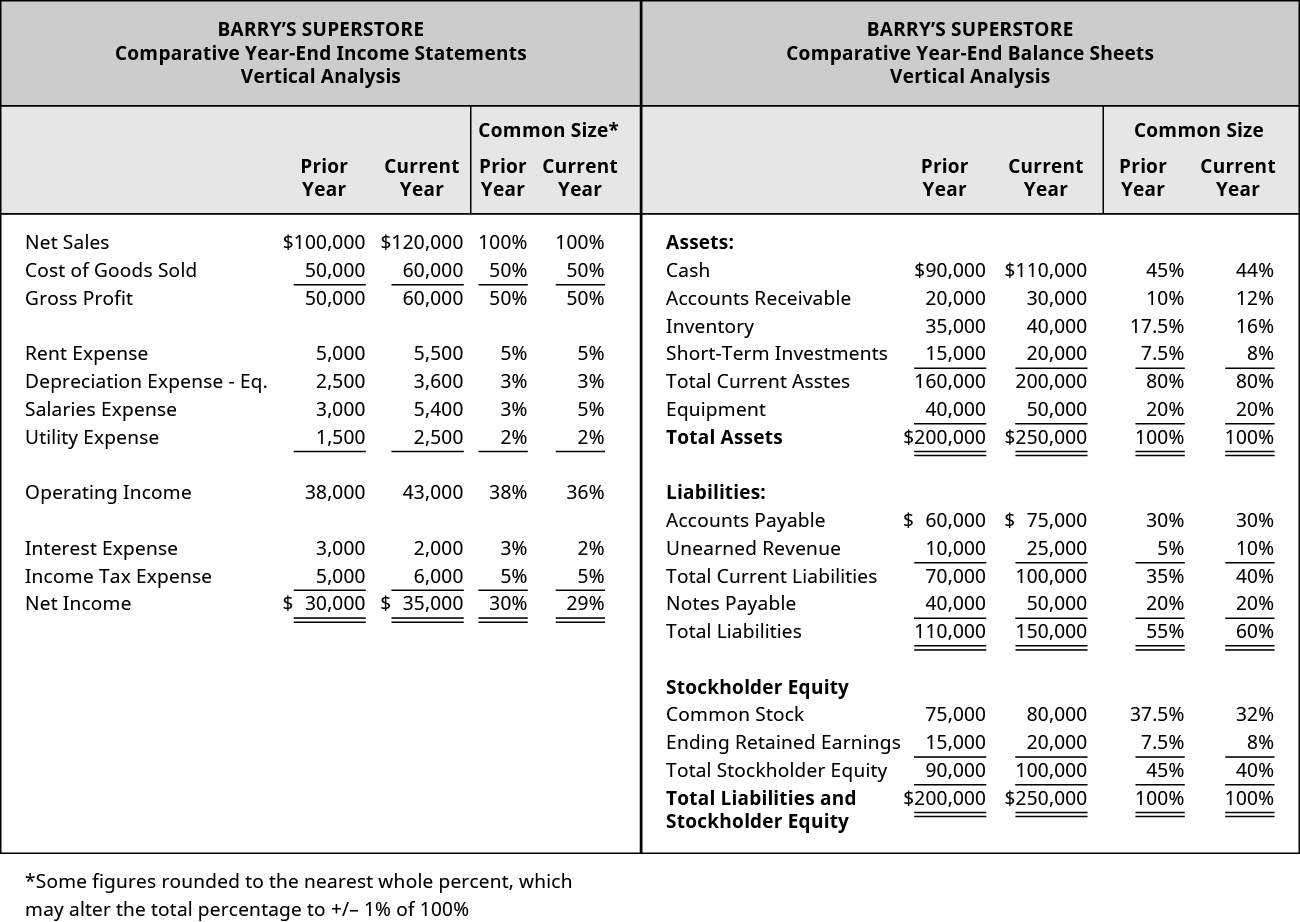

The Common Size Analysis Of Financial Statements

Income Statement Balance Sheet Cash Flow.

. Organizations usually define their accounting periods to coincide with the fiscal year. Both report information presented over a period of time. Assets liabilities shareholders equity.

If the accounting period of a company is for a 12-month period but ends on a date other than December 31 it is referred to as a fiscal year or financial year as opposed to a calendar year. A complete se t of financial stat ement includes all of the follo wing components except. Each particular of financial statements are shown as a percentage of total of some common base.

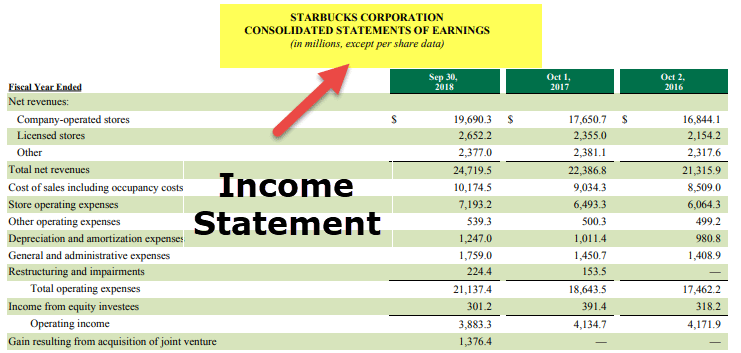

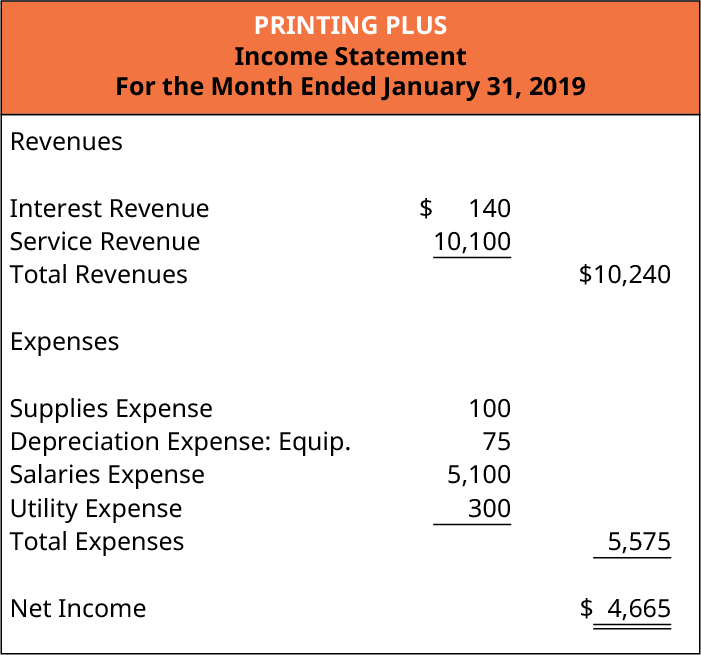

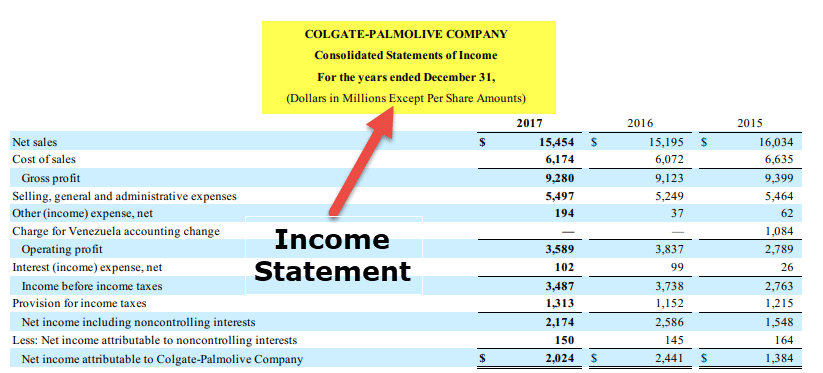

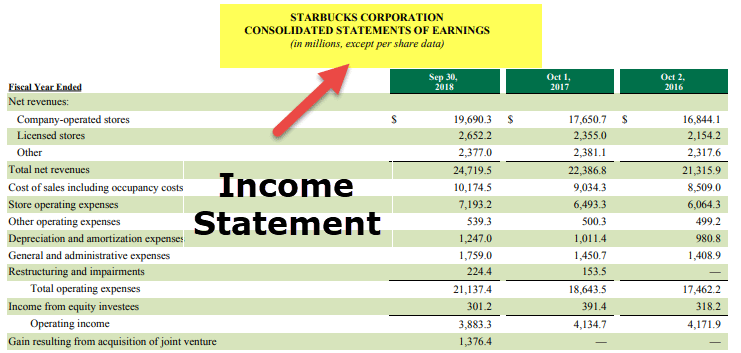

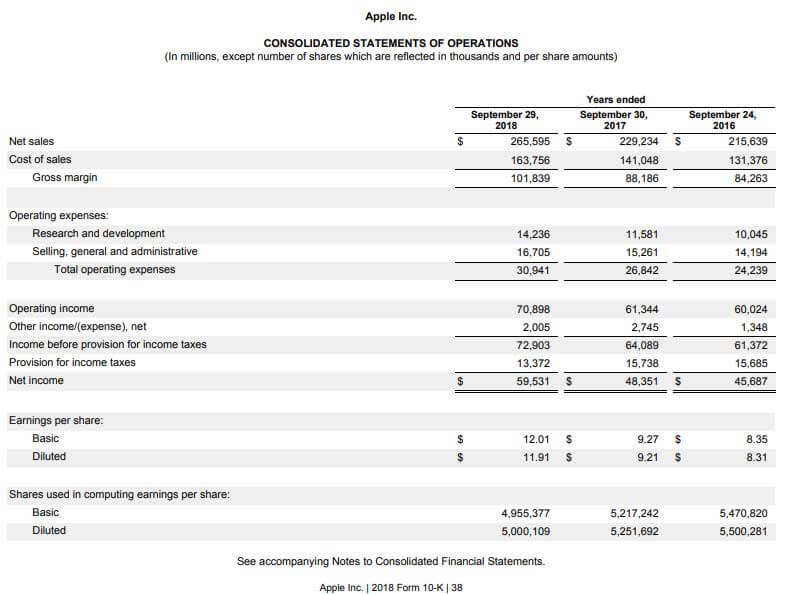

An income statement also known as a profit and loss PL statement shows you your businesss profits and losses over a certain period of time. The Income Statement and the Statement of Cash Flows. The accounting period usually coincides with the business fiscal year.

On rare occasions a reporting period may be for a shortened time period such as a. Select the correct reporting time period for each financial statement. You must include in the header of a financial statement the time period covered by the statement.

This section can also be applied to the preparation of other historical financial information eg schedule of rents. An accounting period is the time frame for which a business prepares its financial statements and reports its financial performance and position to external stakeholders. Financial Reporting Chapter 2 Combined STUDY.

Knowledge Check 01 Select the correct reporting time period for each financial statement. Income Statement Balance Sheet Statement of Retained Earnings Statement of Cash Flows Item 3 Item 4. The following three major financial statements are required under GAAP.

Going concerns concept assumes that the enterprise continues for a long period of time. Take a look-see at the different types of financial statements below. Typically four quarterly periods.

Applicability - AR-C Section 70. Investing activities generated negative cash flow or cash outflows of -10862 for the period. Date of approval of financial statements- is the date that comprise the financial statement including the related notes have been prepared and those with the recognised authorised have asserted that they have taken responsibility for those financial.

Operating activities generated a positive cash flow of 27407 for the period. The cash flow statement. Presentation of the Time Period in Financial Statements.

A point in time. Your income statement shows you your income and expenses. Create a column definition that includes a Financial Dimension column for each company.

Select the correct reporting time period for each financial statement. Accounting questions and answers. Knowledge Check 01 Select the correct reporting time period for each financial statement.

This could be after three six or twelve months. Select the correct reporting time period for each financial statement. Choose the Correct Answer.

For each indicate whether the statement is correct or incorrect. March 28 2019. A change statement that summarizes the profit-generating activities of a company that occur during a particular period of time.

Step 3 Report Correction of Error Reporting the correction of the. Increases and decreases in cash. B Profit or Loss Account.

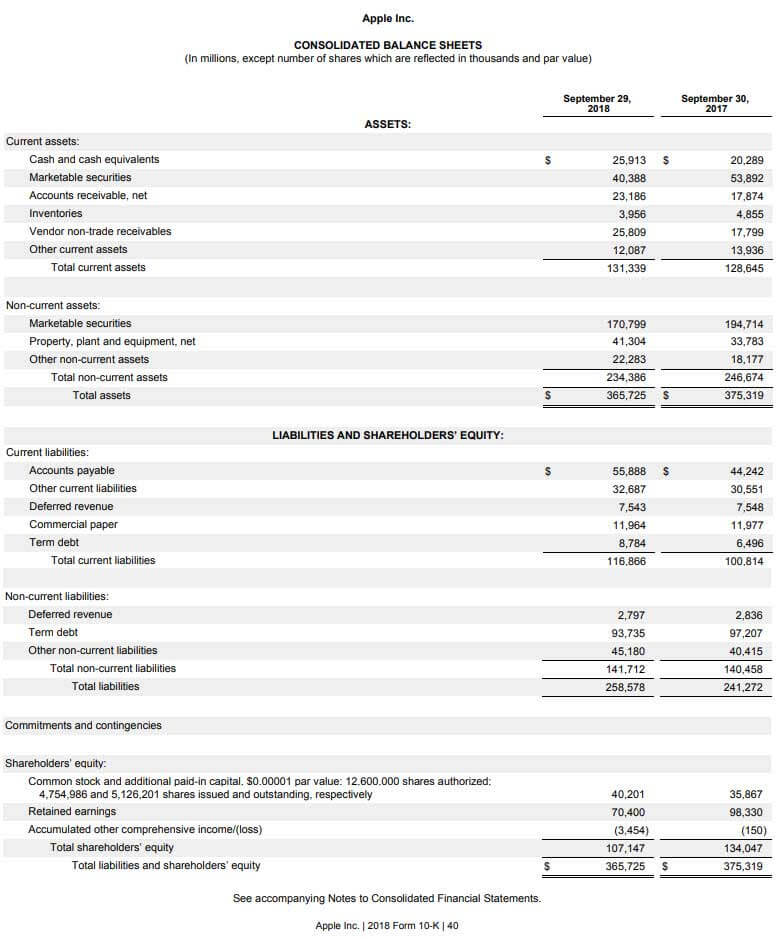

For example an income statement or statement of cash flows may cover the Eight Months ended August 31 However the balance sheet is dated as of a specific date rather than for a range of dates. The income statement recaps the revenue earned by a. A reporting period is the span of time covered by a set of financial statements.

Notes comprising a summary of significant acc ounting policies and other expl anatory. Statement of financial position state ment of co mprehensive inco me and state ment of cash. Depending on the interested audiences requirements the reporting period can be for a month quarterly semi-annually or annually.

It is common for these companies to also have monthly accounting periods. Common accounting periods for external financial statements include the calendar year January 1 through December 31 and the calendar quarter January 1 through March 31 April 1 through June 30 July 1 through September 30 October 1 through December 31. Statement of chang es in equity.

Here are the high-level steps to view companies side by side on consolidated financial statements. Which accounting method will result in financial statements that report a more complete picture of a corporations financial position and a better measure of profitability during a recent accounting year. The primary means of communicating financial information to external parties.

Use the Reporting Unit field to select the tree and reporting unit for each column. Materiality should be assessed with respect to the misstatements impact on prior period financial statements and in the event prior period financial statements are not restated or adjusted with respect to the impact of the misstatements correction on the current period financial statements. The accounting period therefore is also known as the Reporting Period.

Add headers and total columns. Which type of journal entries are made at the end of each accounting period so that the financial statements better. Accounting questions and answers.

All companies complete the cycle and end the period by sending reports on the periods financial activities to tax authorities. Organizations use the same reporting periods from year to year so that their financial statements can be compared to the ones produced for prior years. AR-C section 70 Preparation of Financial Statements is applicable when a public accountant is engaged to prepare financial statements or prospective financial information.

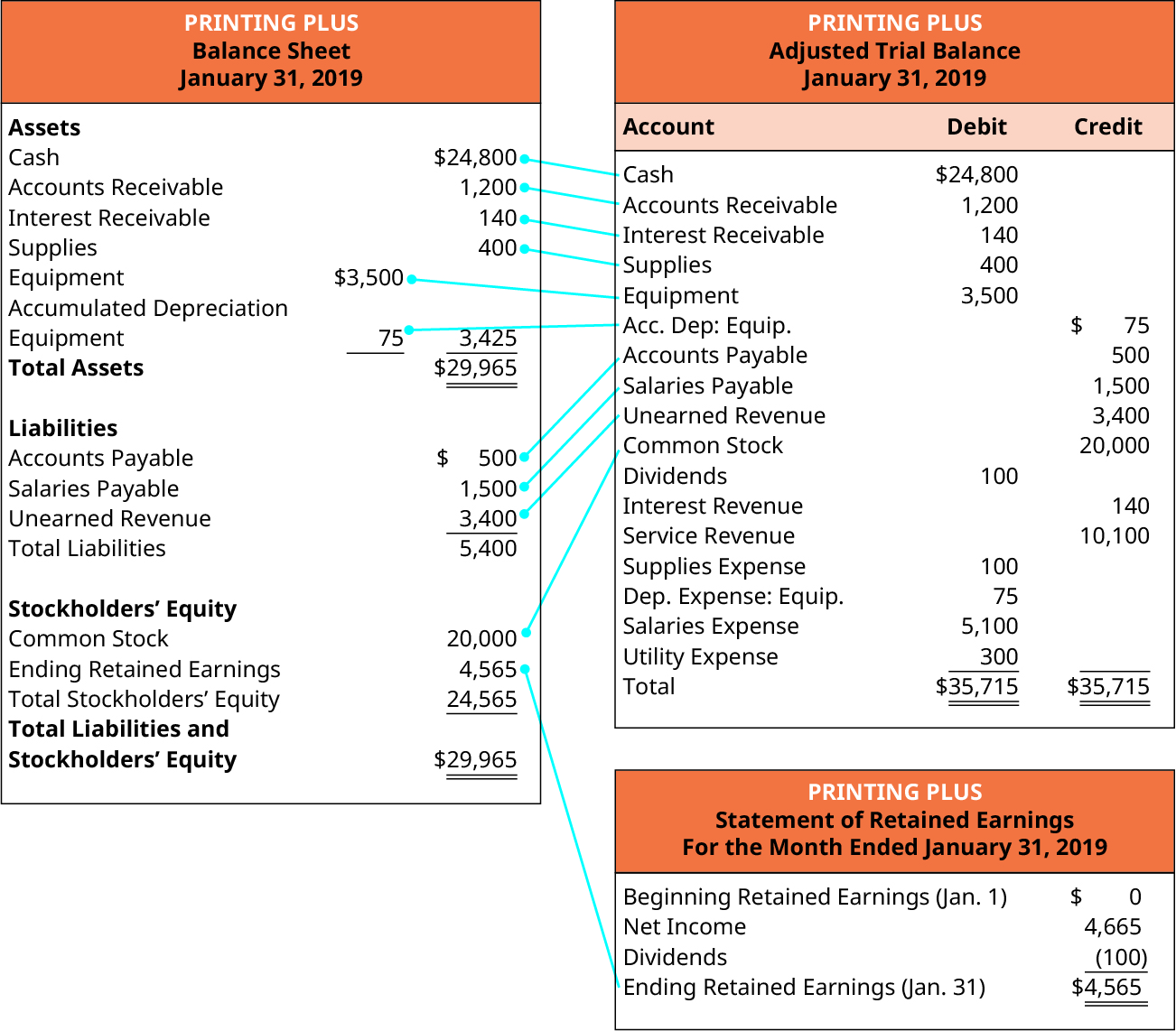

The following statements relate to auditor reporting on financial statements prepared using special-purpose financial reporting frameworks. Balance Sheet Statement of Cash Flows Income Statement Statement of Owners Equity Item 3. The balance sheet the statement of retained earnings the income statement and the statement of cash flows use data from the trial balance and other financial statements for their preparation.

Financial statements of a company include. Indicate the order the financial statements are prepared. Statement of comprehensive income.

It is typically either for a month quarter or year.

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Financial Statements Examples Amazon Case Study

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

Financial Statements Definition Types Examples

Financial Statements Examples Amazon Case Study

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Financial Statements 101 How To Read And Use Your Balance Sheet

Financial Statement Examples Step By Step Explanation

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Financial Statement Definition Basics Explanation

Financial Statement Definition Basics Explanation

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Components Of Financial Statements Overview Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

Financial Statements Definition Types Examples

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Financial Statement Examples Step By Step Explanation

Sample Balance Sheet And Income Statement For Small Business

Comments

Post a Comment